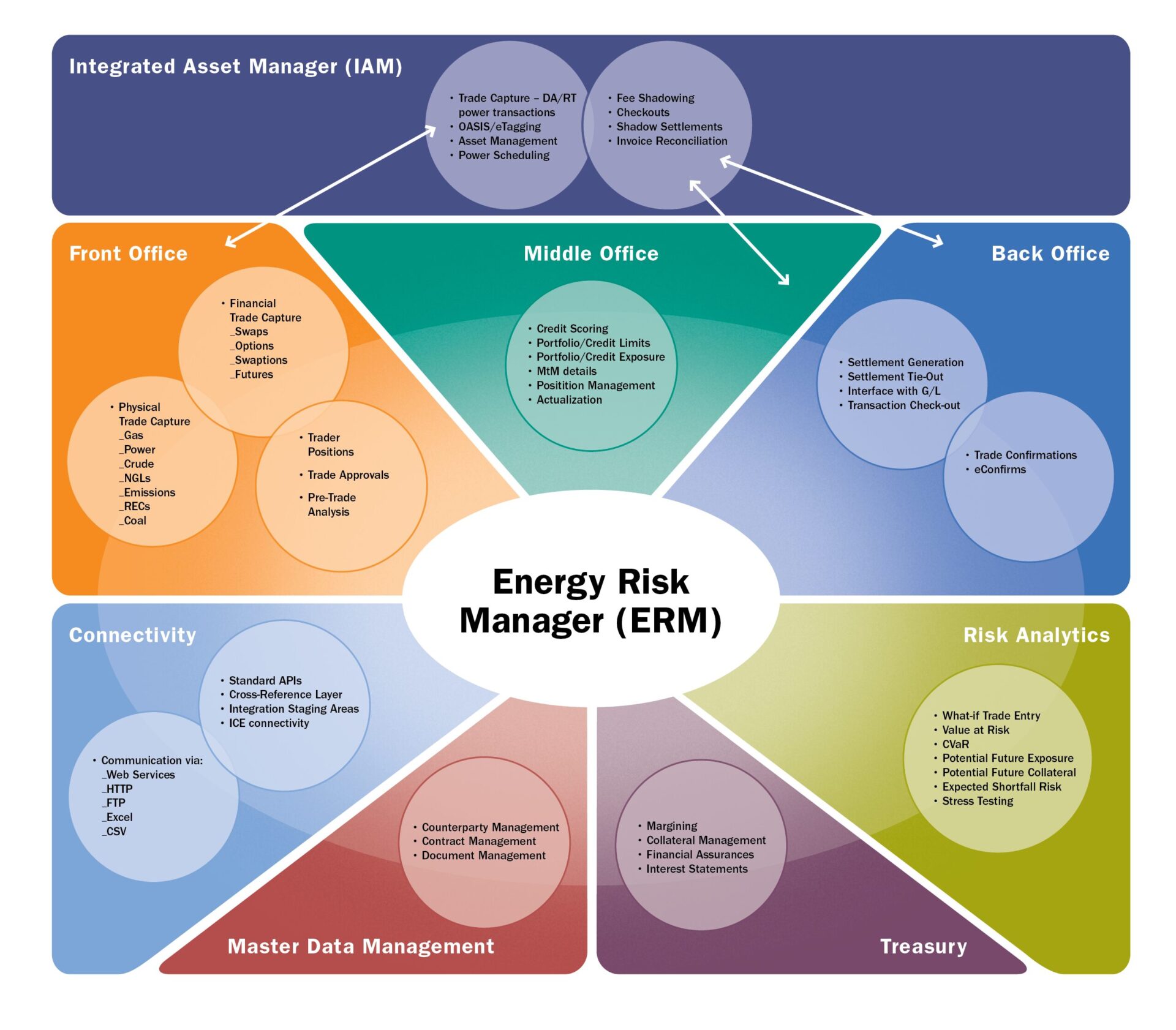

A fully integrated energy trading, credit, and market risk management solution for complex, multi-commodity energy companies. ERM manages the entire risk management process throughout the transaction life cycle.

Paragon

ERM Software

MCG Energy’s Paragon ERM provides a consistent approach to market and credit risk for compliance with credit and market exposure policies and limits. The system’s highly configurable reporting and workflow functionality is easily managed by business analysts. ERM is natively integrated with MCG Energy’s Integrated Asset Manager (IAM) for physical and financial trade capture.

ERM combines state-of-the-art technology with a rich feature set to deliver the most powerful ETRM system available. MCG Energy’s Hosted Data Services (HDS) merges data from ERM and all other MCG Energy software products into one hosted platform. HDS is a data warehousing solution for all MCG applications.

ERM provides a comprehensive real-time picture of complex gas and power portfolios, risk metrics, and limits to ensure compliance with your organization’s risk policy. ERM enables traders and utility merchants to manage forward exposure with a rich set of reporting and risk metrics. These include custom reports and workflows that business analysts can use without programming knowledge or IT assistance.

Paragon ERM

Energy Risk Manager – Key Features

Paragon ERM

Energy Market Risk Management Software Solutions

Market Risk

Provides tools for assessing market risk including Monte Carlo Value at Risk with backtesting (MC VaR), Historical Value at Risk (H VaR), historical (event-based) stress tests, and user-designed stress tests.

Credit Risk

Measures credit exposure utilizing Credit VaR, Potential Future Collateral (PFC), Potential Future Exposure (PFE), walk forward (expected transactions going forward with no price change), expected/unexpected risk, stress testing, and What If transaction modelling for the impact of proposed trades on credit lines.

Optimize Your Energy Trading & Risk Management

Ready to take the next step? Contact our energy risk management sales department today to learn how to customize the energy trading & risk management software for your organization, optimize trading strategies, mitigate risk, and achieve greater profitability.