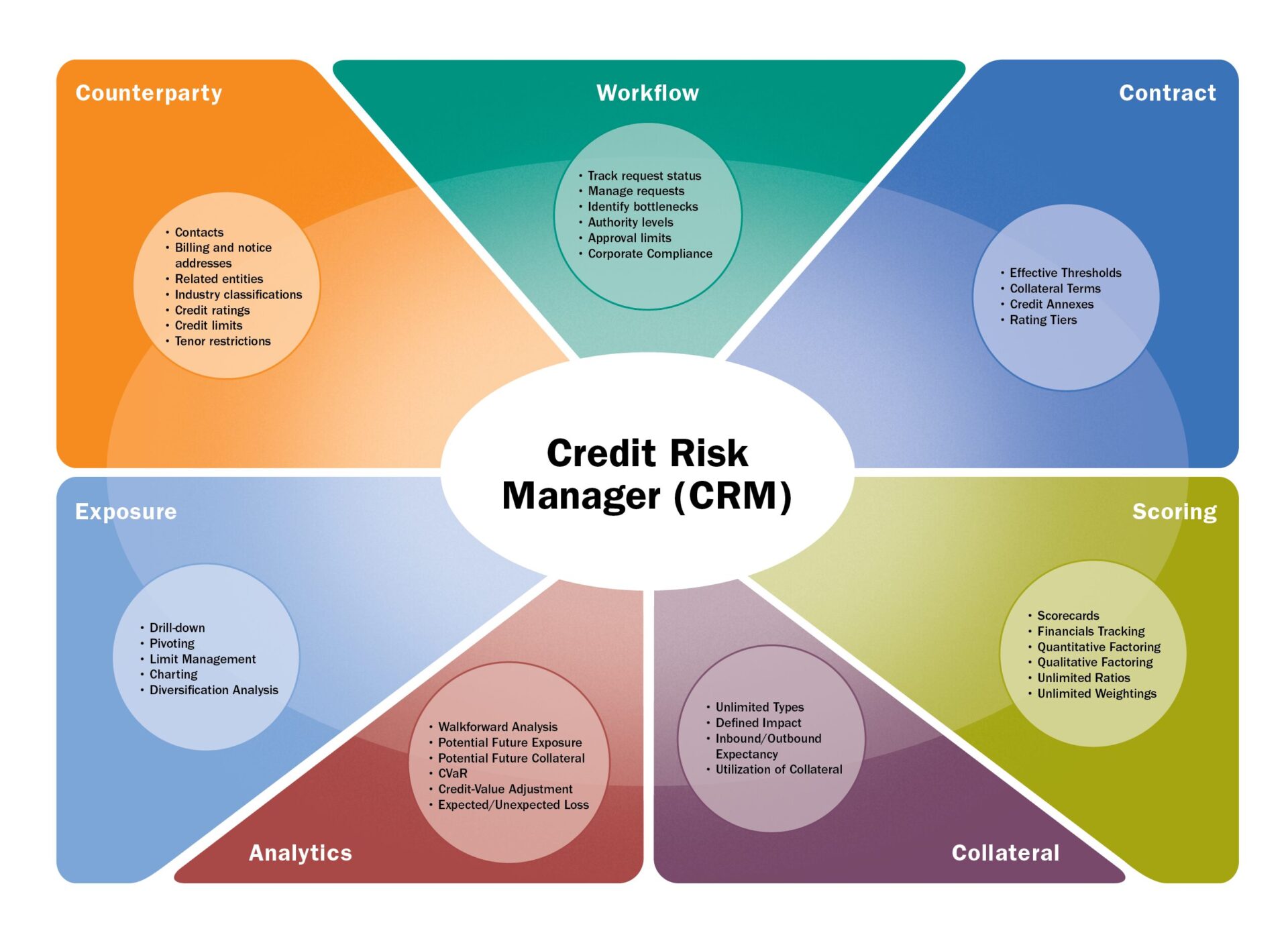

Combines state-of-the-art technology with a rich feature set for credit risk management including counterparty, contract, collateral, exposure, advanced credit analytics, and credit scoring. Our highly flexible and user-friendly application is easily configured to meet the nuances of each client’s credit risk requirements.

Paragon

CRM Software

CRM encompasses the entire scope of credit risk management to ensure consistent and efficient adherence to the credit policies of your organization.

MCG’s Hosted Data Services (HDS) product merges data from CRM and all other MCG software products into one hosted platform for reporting and data warehousing.

Paragon Credit Risk Manager (CRM) encompasses the entire scope of credit risk management software for energy industry leaders to ensure consistent and efficient adherence to your organization’s credit policies. This highly flexible application is easily configured to customer preferences, enabling users to create custom views of each screen that can be shared with other users and leveraged to create reports.

MCG Energy’s Paragon CRM Software

Credit Risk Management Software – Key Features & Benefits

Credit Risk Management Software Built for Energy Industry Leaders

MCG Energy’s Paragon CRM offers a distinct advantage for energy industry leaders seeking robust and tailored solutions. Unlike generic credit risk management software, Paragon is specifically designed with the complexities of the energy sector in mind. Our understanding of power and gas trading, scheduling, and settlement processes allows us to provide a solution that seamlessly integrates credit risk management with your core operations.

Discover how Paragon, combined with our state-of-the-art energy SaaS, can streamline your credit processes, mitigate risk, and enhance your decision-making in the energy sector.