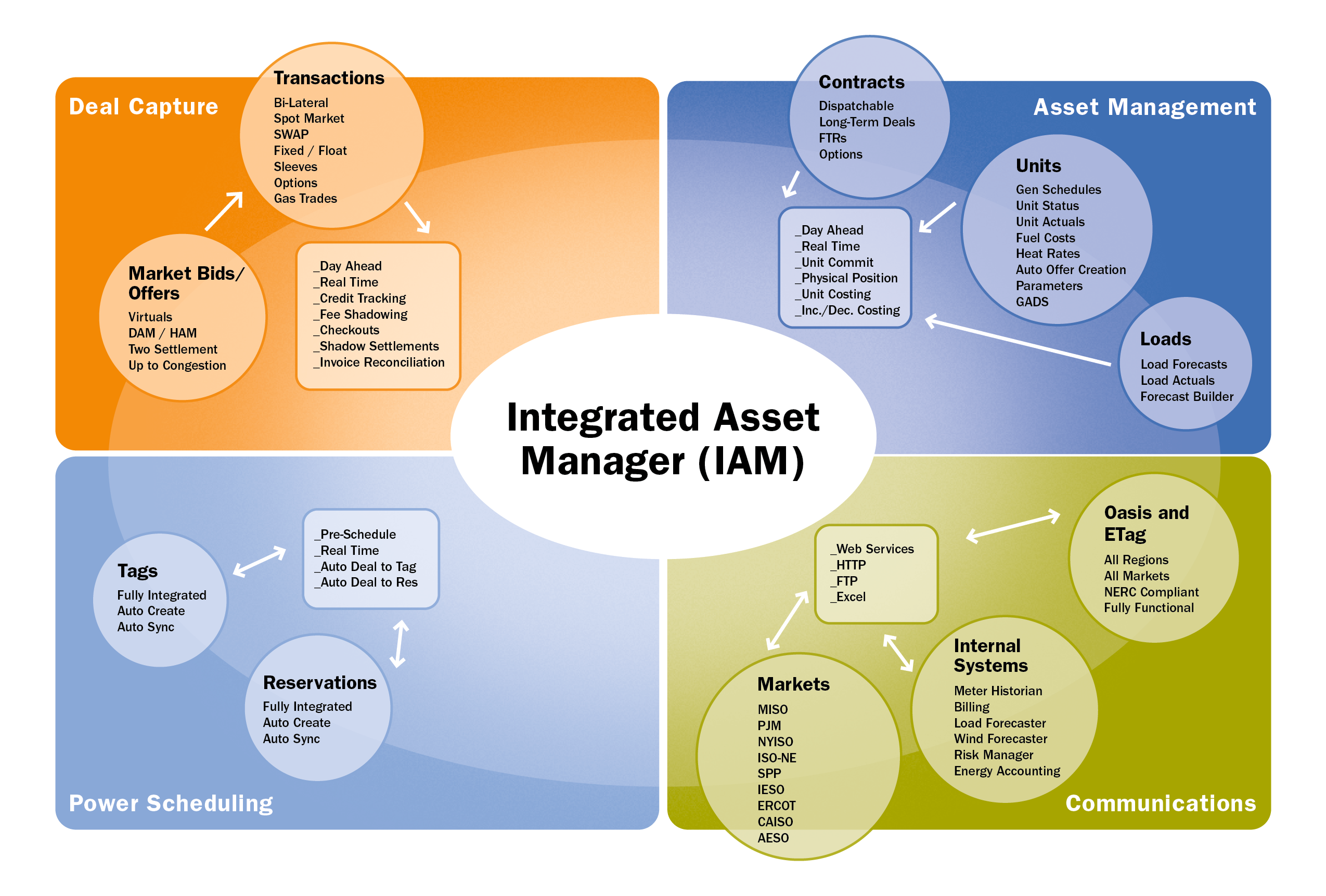

A full featured, easy-to-use energy trading and energy scheduling software solution. IAM’s integrated asset management functionality includes bid capture, physical scheduling and tagging, market submissions, market clearing, real-time scheduling, performance reporting, and settlements. IAM fully supports scheduling and market submissions with all North American regions, ISOs, and RTOs.

MCG Energy’s Integrated Asset Manager

IAM’s integration means that information must be entered only once to create bids/offers, OASIS reservations, and e-Tags while adjustments and curtailments are automatically reflected in positions and performance reports. This makes settlement reconciliation easy with ISOs and counterparties, including drill-downs into the individual trades and tags of each settlement charge.

IAM is also a single system for managing generation and load forecasting, planning, submissions, positions, and settlements. It can be used to create load forecasts visually based on similar days, auto-create demand bids for submission to markets, import generation forecasts from your unit optimizer, manage unit parameters and auto-generate market bids, track market awards, and see scheduled vs. actual volumes in a single, fully integrated asset management platform. IAM also enables you to manage generation, load, physical flows, e-Tags, transmission inventory, market data, prices, and settlements in one platform while seamlessly scheduling, tracking, and settling assets.

In addition, IAM energy scheduling software is an easy-to-use contract and transaction management system for the capture and scheduling of natural gas products, generation of confirmations, and performing checkouts and settlements. MCG Energy’s Hosted Data Services (HDS) merges data from IAM and all other MCG Energy software products into one hosted platform for reporting and data warehousing.

Work in All North American Energy Markets

MCG Energy’s IAM is a fully-integrated wholesale energy marketing and trading solution integrated with all North American physical bilateral markets and ISOs. Its user-friendly scheduling interface streamlines workflow for managing front-office and back-office operations including trade capture, transmission reservation management, fully integrated native e-Tagging, scheduling, bidding, dispatch, settlement, and reporting for all resources and loads.

IAM simplifies complex physical, financial, and ISO market operations, allowing an organization to focus on the important aspects of maximizing its operational efficiency and financial performance.

MCG Energy’s Integrated Asset Management Software Key Features

MCG Energy’s Integrated Asset Manager (IAM) Key Benefits

MCG Energy

IAM Shadow Settlement Functionality

As a fully-integrated wholesale energy marketing and trading solution with coverage across all North American power markets, IAM’s ISO Shadow Settlements enable customers to shadow and evaluate charges at the determinant level of granularity across all markets.

MCG Energy’s IAM Shadow Settlement Key Features

IAM Utilizes Market Rules

and calculations to create the shadow from the data inside the system and compares it to data from the ISO settlement. IAM uses color formatting and “problem only” functionality to efficiently identify differences between the two independent sources of data.

IAM Allows Comparison

of Shadow Data to ISO data for a given operating date, it also compares ISO settlement revisions. This function quickly identifies differences from one settlement to another all the way down to the market determinant level. The visibility of settlement revision differences allows an organization to plan for material affects to cash flow as well as explain differences to management.

MCG Energy’s IAM Shadow Process Key Elements

MCG Energy

EIM Solution for Merchant Operations

Energy Imbalance Market (EIM) participants need tools to manage both new and legacy business requirements. MCG Energy’s suite of applications provides an elegant and robust solution designed to meet the demanding needs of EIM participants.

MCG Energy’s EIM Solution for Merchant Operations

Alternative solutions only address a segment of requirements. Only MCG Energy’s EIM Market solution addresses all aspects of the EIM in a comprehensive, integrated manner. MCG Energy’s products, experience, and system implementation record makes our solution for the EIM a wise management decision.

IAM is a comprehensive, integrated system for communication, as well as physical scheduling, trade capture, and asset management with the EIM. The system manages base schedule creation and submission, Bid/Offer/Parameter Submissions, Award retrieval, Shadow Settlements, and related reporting. IAM e-Tagging and transmission inventory management functionality is also used in physical scheduling. Assets including units, contracts, and load obligations are modeled in IAM to communicate with the market, and for internal analysis.

- MCG Energy Accounting System (EAS) – Meter data management, and related calculations such as Net Scheduled Interchange and Net Actual Interchange, are performed in MCG EAS. Meter data submission to the market is a standard functionality of EAS, which is natively integrated with other MCG Energy applications, decreasing implementation risk and cost.

- MCG Hosted Data Services (HDS) – Provides a user interface and programmatic access to the data created and received by all MCG Energy applications, and an efficient tool to run reports for large date ranges across multiple systems. The programmatic interface allows organizations to pull data as needed directly into internal systems with no direct involvement from MCG Energy. When hosted in MCG’s NIST SP 800-53 r4 complaint datacenters, HDS requires no table or hardware maintenance by the customer.

MCG Energy Solutions for the EIM

Base Schedule Data Creation

Allows the participating Resource Scheduling Coordinator to submit base schedule data, bid range data, and outage data for non-participating resources to the Entity Scheduling Coordinator for aggregation, and to forward to the market.

Settlements

The settlement subsystem pulls and displays settlements data from the EIM, and provides shadow calculations based on submitted data, accepted schedules, dispatches, and market prices. Multiple settlement statements can be aggregated for invoice reconciliation.

Meters and Calculations

Manages schedule and meter data from multiple data sources. Rollups and calculations allow for the visualization of your system as well as feeding internal billing systems. Meter data submission to the EIM can be performed manually or automated.